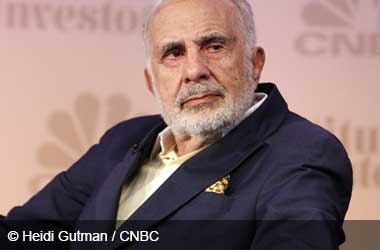

Billionaire Carl Icahn Butts Heads With Caesars Board On Casino Sale

The Caesars Entertainment Board of Directors is not pleased with billionaire Carl Icahn’s eagerness to make a sale and dispose the casino chain. Investor Icahn and the Board are reportedly disagreeing on the share prices of America’s largest gaming company Caesars, amidst the $6.2-billion firm’s on-going talks about a potential merger with rival casino operator Eldorado.

The 83-year-old mogul started the auction of the Caesars Casino chain at $13 a share. Eldorado, the operator of popular casino brands such as Lady Luck and Isle of Capri, had countered with a $10.50 a share bid in early June. While it looks like Icahn is inclined to accept the offer, the Board unanimously dismissed the proposal as too low.

Icahn owns a 28.5 stake in Caesars and has been one of the key forces who has pushed for the sale of Caesars. Eldorado disclosed earlier this week that it sold about $385 million in assets, casinos and real estate. The proceeds from the sale are expected to go towards Eldorado’s stock-and-cash offer for Caesars, which is also the parent company of Harrah’s and Bally’s.

KTNV Channel 13 Las Vegas

Caesars’ Debt Being Leveraged In Sale of Shares

Caesars has more than $18 billion in net debt that will be assumed by its merged company. The casino company went through bankruptcy in 2015 after being weighed down by its liabilities.

Eldorado has stated that it is not very keen on taking on debt levels that exceeds 5.5 times which can be the reason why Icahn is pushing for a lower share price. Investment bank Jefferies said the debt may be leveraged to negotiate an offer price of under $12 a share.

A report from a Jefferies analyst showed that if Eldorado agreed on $11.50 a share, then the company would have a debt of 5.4 times its Ebitdar and have to assume $500 million in synergies. Sources say that the deal between Caesars and Eldorado is cutting close with the former trying to negotiate a share price that will please all their shareholders.

Icahn has a big stake in Caesars and with 3 appointees on the eight-member board on his side, he will most likely call the shots, given the fact that he has an influence on the new Caesars CEO. The billionaire investor acquired much of his Caesars stock in January for around $9 a share and many believe his sole purpose was to sell the company.

Recent Posts

Marina Bay Sands Secures $9bn Loan for Casino Hotel Expansion

Summary: Las Vegas Sands secured a $9 billion loan for Marina Bay Sands' expansion in…

LV Sands, Concerned About Online Competition Amid Plan to Build $6bn Casino

Summary: Las Vegas Sands chairman and CEO Rob Goldstein is concerned about the impact of…

Biloxi Casino Plans Advance as MGC Considers Two Venues

Summary: Tullis Gardens Hotel and the Tivoli development are in the works. The casinos would…

Rio Hotel & Casino Finishes Phase One of Massive Property Renovation Project

Summary: Rio Hotel & Casino has completed phase one of its multi-year property-wide renovation project.…

Industry Heavyweight Execs Talk Tech Future at TribalNet Conference & Tradeshow

Summary: Monday’s TribalNet Conference & Tradeshow brought together gaming industry executives who discussed the future…

Nevada Regulators Propose Solution for Armed Casino Security Shortage

Summary: The Nevada Gaming Control Board addressed the shortage of armed casino security following the…